As the global demand for lithium continues to soar, lithium producers stock has emerged as a highly sought-after investment opportunity. Lithium, a critical component in electric vehicle (EV) batteries and renewable energy storage systems, is driving the transition to a greener future. Investors looking to capitalize on this trend must understand the key players and factors influencing the lithium market. In this article, we will delve into the top lithium producers stock and explore why they are essential for building a diversified portfolio.

With the rapid advancements in technology and increasing adoption of electric vehicles, lithium has become indispensable. The demand for lithium-ion batteries is expected to grow exponentially over the next decade, making lithium producers stock an attractive option for investors seeking long-term gains. However, it’s important to understand the nuances of this market to make informed decisions.

This article aims to provide a detailed overview of the top lithium producers stock, their market performance, and the factors that influence their growth. Whether you’re a beginner or an experienced investor, this guide will equip you with the knowledge needed to navigate the lithium market successfully.

Read also:Kelly Ripa And Family Pics A Closer Look At The Stars Personal Life

Table of Contents

- Introduction to Lithium Producers Stock

- Major Lithium Producers in the Market

- Market Trends Shaping Lithium Producers Stock

- Investment Opportunities in Lithium Producers Stock

- Risks and Challenges for Lithium Producers

- Future Outlook for Lithium Producers Stock

- Top Lithium Producers Stock to Watch

- Factors Influencing Lithium Prices

- Geopolitical Impacts on Lithium Production

- Conclusion and Call to Action

Introduction to Lithium Producers Stock

Lithium producers stock refers to publicly traded companies involved in the extraction, processing, and supply of lithium. These companies play a crucial role in meeting the growing global demand for lithium, which is primarily driven by the electric vehicle (EV) industry and renewable energy storage solutions. As the world shifts towards sustainable energy sources, lithium has become a cornerstone of modern technology.

The lithium market is highly dynamic, with several factors influencing its performance. From supply chain disruptions to geopolitical tensions, investors need to stay informed about the latest developments to maximize their returns. In this section, we will explore the basics of lithium producers stock and why they are gaining prominence in the financial markets.

Investing in lithium producers stock offers several advantages, including exposure to a rapidly expanding industry and potential for significant returns. However, it’s essential to conduct thorough research and analysis before committing capital to ensure alignment with your investment goals.

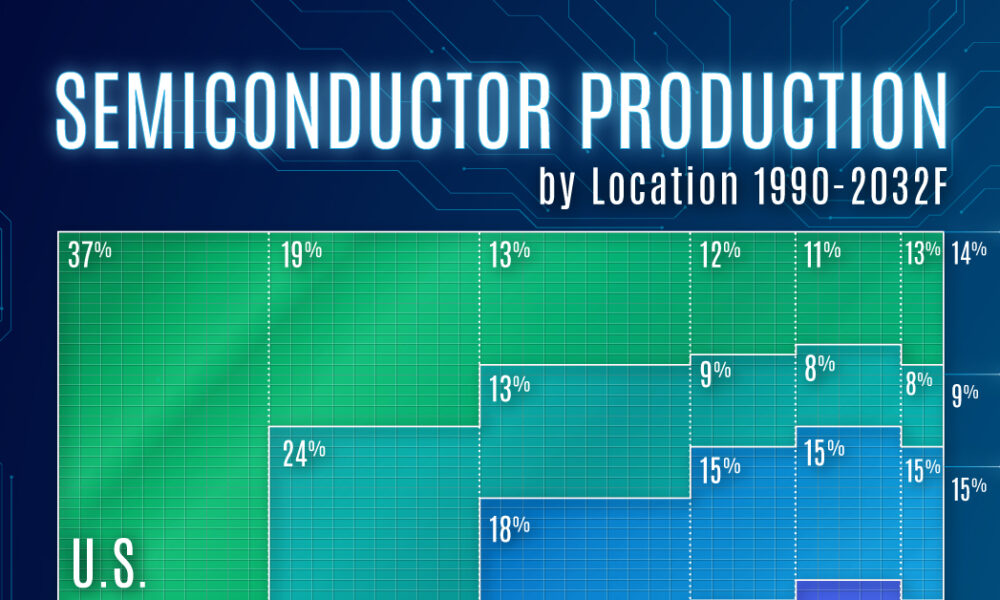

Major Lithium Producers in the Market

Top Lithium Producers Stock to Watch

Several companies dominate the lithium production landscape, each with its unique strengths and strategies. Below is a list of the top lithium producers stock that investors should consider:

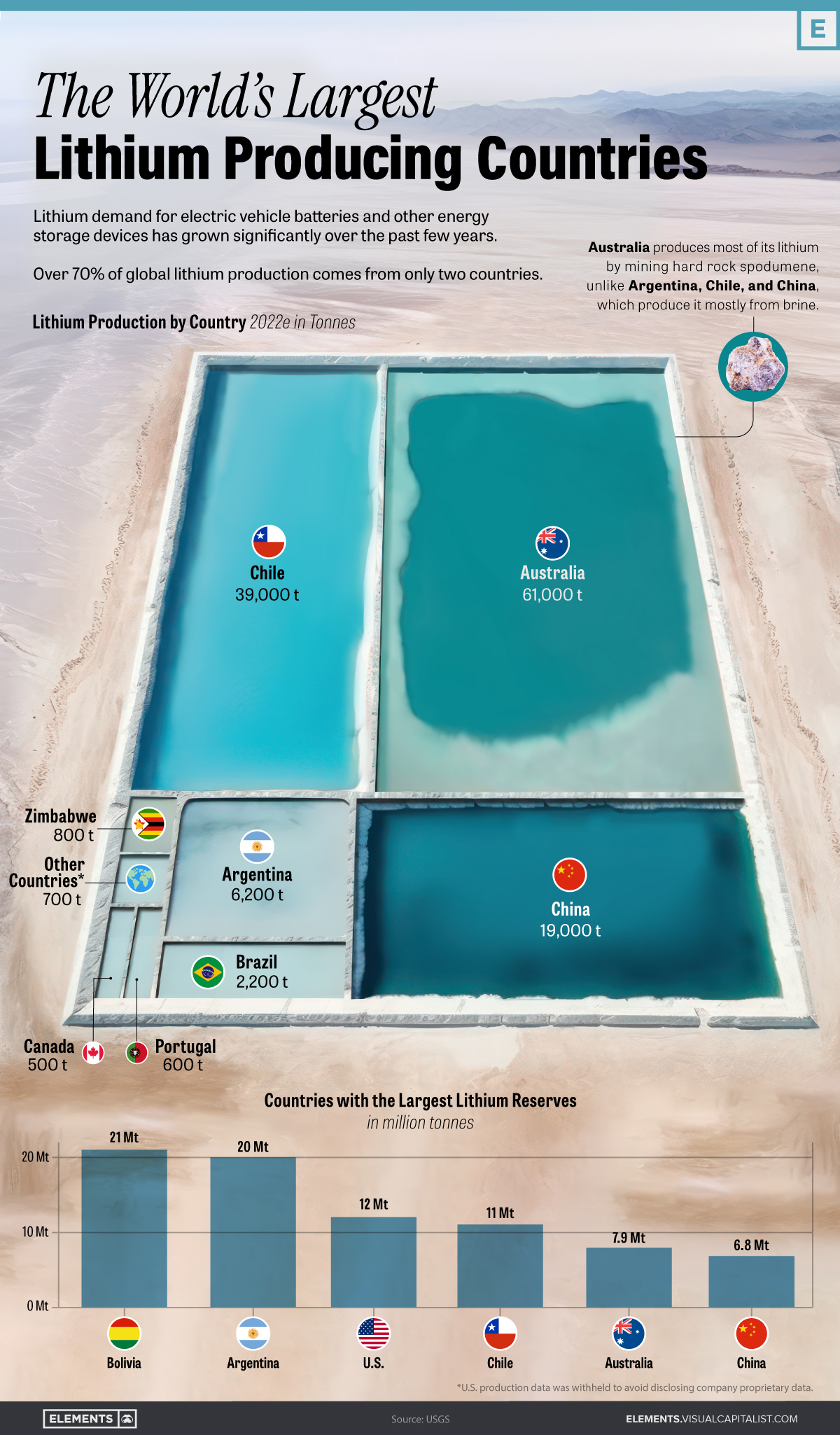

- Albemarle Corporation: A global leader in lithium production, Albemarle operates in key regions such as Chile and Australia. The company’s robust portfolio includes lithium hydroxide and carbonate, catering to various industries.

- Sociedad Química y Minera de Chile (SQM): Based in Chile, SQM is one of the largest lithium producers in the world. The company leverages its strategic location in the Atacama Salt Flat to extract high-quality lithium at competitive costs.

- Lithium Americas Corp: Focused on developing lithium projects in North and South America, Lithium Americas Corp is rapidly expanding its operations to meet growing demand.

Factors Influencing Lithium Prices

Lithium prices are influenced by a combination of supply and demand dynamics, technological advancements, and global economic conditions. Some of the key factors include:

- Demand from Electric Vehicle Manufacturers: The EV industry is the largest consumer of lithium, driving significant price fluctuations.

- Supply Chain Constraints: Disruptions in mining and processing operations can lead to temporary price spikes.

- Government Policies: Subsidies and regulations related to renewable energy can impact the demand for lithium.

Market Trends Shaping Lithium Producers Stock

The lithium market is experiencing rapid growth, driven by several key trends. The increasing adoption of electric vehicles, advancements in battery technology, and the push towards sustainable energy are reshaping the industry landscape. Investors must stay updated on these trends to capitalize on emerging opportunities.

Read also:Navigate To Jfk Airport Your Ultimate Guide To A Seamless Travel Experience

Data from the International Energy Agency (IEA) indicates that global lithium demand is expected to increase by more than 40% over the next five years. This growth is fueled by the expansion of EV production and the deployment of large-scale energy storage systems. As a result, lithium producers stock is poised for significant appreciation.

Investment Opportunities in Lithium Producers Stock

Investing in lithium producers stock offers numerous opportunities for diversification and growth. Whether you prefer blue-chip stocks like Albemarle Corporation or emerging players like Lithium Americas Corp, there are options to suit every investor profile. Below are some strategies to consider:

- Long-Term Growth: Focus on established companies with a proven track record of delivering consistent returns.

- Speculative Investments: Explore smaller companies with high growth potential but higher risk.

- Exchange-Traded Funds (ETFs): Consider ETFs that track the performance of lithium producers stock for a diversified approach.

Risks and Challenges for Lithium Producers

Geopolitical Impacts on Lithium Production

While the lithium market offers immense potential, it is not without risks. Geopolitical tensions, environmental concerns, and regulatory challenges can impact production and profitability. For instance, the concentration of lithium reserves in countries like Chile, Argentina, and Australia makes them vulnerable to political instability.

Additionally, the environmental impact of lithium mining has raised concerns among stakeholders. Companies must adopt sustainable practices to mitigate these risks and ensure long-term viability. Investors should carefully evaluate these factors when selecting lithium producers stock for their portfolio.

Future Outlook for Lithium Producers Stock

The future of lithium producers stock looks promising, with the global shift towards sustainable energy driving demand. As electric vehicles become more affordable and widely adopted, the need for lithium-ion batteries will continue to grow. This presents a unique opportunity for investors to capitalize on the transition to a greener economy.

According to a report by BloombergNEF, the lithium-ion battery market is expected to reach $116 billion by 2030. This growth will be driven by advancements in battery technology, increased EV production, and the deployment of renewable energy storage systems. Lithium producers stock is well-positioned to benefit from these trends, making them an attractive investment option.

Conclusion and Call to Action

In conclusion, lithium producers stock represents a compelling investment opportunity for those looking to capitalize on the global transition to sustainable energy. By understanding the key players, market trends, and risks involved, investors can make informed decisions and build a diversified portfolio. Whether you choose to invest in established companies or emerging players, the lithium market offers significant potential for growth.

We invite you to share your thoughts and insights in the comments section below. If you found this article helpful, please consider sharing it with your network. Additionally, explore our other articles on sustainable investing and financial markets for more valuable information. Together, let’s navigate the future of investing in lithium producers stock!